Events over the past few years have caused many informed observers to be concerned over the increased precariousness of our strategic horizon. In addition to natural disasters-such as Hurricane Katrina-and the continuing terrorist threats promising a major sequel to “9/11,” and the probability of rogue nuclear attacks of various kinds, anyone who is relying on smooth waters over the next 12-18 months is simply among the ranks of the under-informed.

To prepare for potentially volatile uncertainties, some years ago we published a series of suggestions, which we called “The Vortex Strategy,” and in view of our current horizon, it seems appropriate to review some of those ideas.

The next major terrorist event could prove to be an even more impacting sequel than “9/11”-whether it is an Al Qaeda plot of some kind, or an EMP attack which threatens to plunge the U.S. back into the 19th century. But without indulging in speculations regarding the challenges that Homeland Security presently faces, many experts are also anticipating a possible upheaval to emerge from the current debt debacle of the United States. What would be the consequences to you and your family if America’s economic foundation was ripped out from under you? We individually can’t change the probabilities of such an event, but what is your action plan to protect yourself and your family?

The Impending Monetary Crisis

We need to understand the precariousness of the U.S. dollar and its role in the international monetary markets: two-thirds of world trade is conducted in dollars; over 70% of central banks’ reserves are held in the American currency; and, the U.S. dollar is the sole currency used by international institutions such as the International Monetary Fund (IMF).

This has conferred on the U.S. a major economic advantage: the ability to run a trade deficit year after year. It can do this because foreign countries need dollars to repay their debts to the IMF, to conduct international trade, and to build up their own currency reserves. A move away from the dollar could have a disastrous effect on the U.S. economy as the U.S. would no longer be able to spend beyond its means.

Worse still, the U.S. would become a net currency importer as foreigners would seek to spend back in the U.S. a large proportion of the estimated three trillion dollars which they currently own. The U.S. would also have to run a trade surplus-the first time in a century-providing the rest of the world with more goods and services than it was receiving in return.

The Oil Exporters

Up until the early 1950s, the U.S. dominated world oil production, so sales of oil and natural gas on international markets had been exclusively denominated in dollars. The U.S. in those days accounted for half or more of the world’s annual oil production. That, of course, has drastically changed: we are entering a period in which we need to import almost 70% of our requirements!

The tendency to price in dollars was additionally reinforced by the 1944 Bretton Woods agreement, which established the IMF and World Bank and adopted the dollar as the currency for international loans. The “gold exchange standard” was also established: the U.S. dollar was to be convertible to gold by foreign governments. However, by the 1970s foreign dollar holdings had grown to five times the available gold. So, in August 1971, President Nixon suspended all gold payments. Today, depreciating paper dollars are backed only by the “reputation” of the U.S. Government

The Quiet Game

While the denomination of oil sales is not a subject that is frequently discussed in the media, its importance is certainly well understood by governments. For example: when President Nixon took the U.S. off the gold exchange standard, OPEC considered moving away from dollar oil pricing, as dollars no longer had the guaranteed value they previously did. The U.S. response was various secret deals with Saudi Arabia in the 1970s to ensure that the world’s most important oil exporter would stick with the dollar. What the Saudis did, OPEC followed.

The Think Tanks Warn

Countries switching to euro reserves from dollar reserves will bring down the value of the U.S. currency. Imports would start to cost Americans a lot more… As countries and businesses convert their dollar assets into euro assets, the U.S. property and stock market bubbles would, without doubt, burst…

-The Foundation for the Economics of Sustainability

The dollar’s position is already on the decline in many countries.

-Federal Reserve Bank of San Francisco

China has officially declared that it will diversify a part of its foreign exchange holdings into oil by building a strategic petroleum reserve. The construction of huge storage tanks has begun and will take several years until completion.

On January 24, 2007, Kuwait announced that it is considering abandoning pegging its dinar to the dollar for fear of an anticipated slide in the value of the dollar. Last year, the central banks of Italy, Russia, Sweden, and the United Arab Emirates had announced similar shifts out of the dollar and into other currencies, or gold, citing the United States’ “twin deficits” (federal deficit and the trade deficit) as the reasons for the expected fall in the dollar’s value.

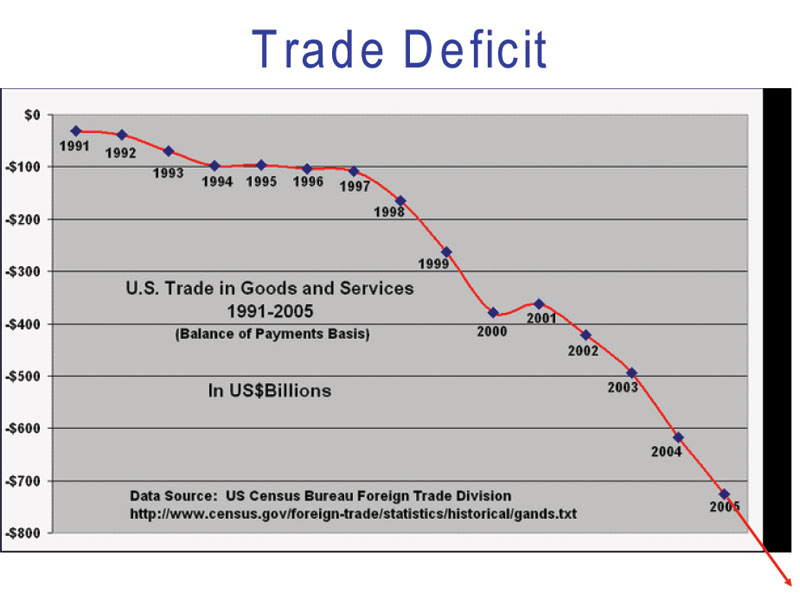

Our Trade Balance

We buy more than we sell (we always have). We finance our purchases with debt currency and our current imbalance (deficit) grows $850 billion per year!

Our Federal Deficit

Our government spends more than it raises (in taxes, etc.), so we finance our government programs with debt. The Bush administration is forecasting that the federal deficit for the 2007 budget year will total $244 billion (a slight improvement from the $248.2 billion actual deficit in 2006). However, the improvement this year is likely to be short-lived as tax revenue growth slows and spending begins to rise to deal with increased Social Security and Medicare payments as the 78 million baby boomers start to retire. Thus, the U.S. Treasury must borrow:

Federal deficit: $250 billion/year

Trade deficit: $850 billion/year

$1,100 billion/year

That’s $3 billion per day! It’s going to be interesting to see who is willing to pick up those notes (and what interest and incentives we’ll have to offer)!

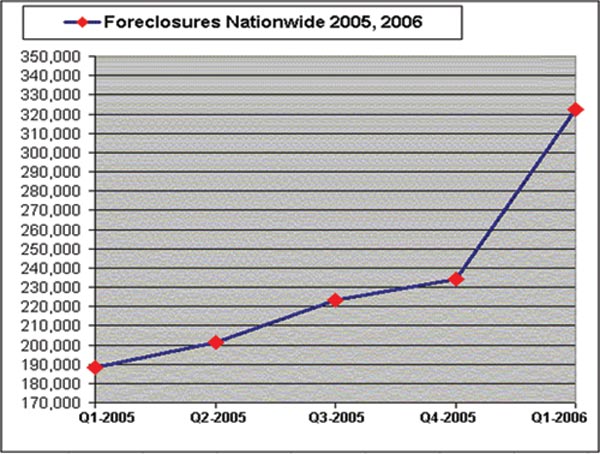

Consumer Debt

Mortgage companies are knocking on doors, sending letters and making phone calls with a simple message for struggling homeowners: They’d rather modify your loan than foreclose. New foreclosures hit their highest ever level in the fourth quarter of 2006, according to the Mortgage Bankers Association. With home values falling in some parts of the country, none of the finance companies want to be stuck owning a house that has depreciated in value.

Critics say lenders made loans to borrowers who weren’t credit worthy with terms that would be impossible for them to meet. Whether the current wave of workouts will merely postpone foreclosures-and delay bad loans hitting lenders’ books-is an open question…

David Walker

David M. Walker, Comptroller General of the United States, has publicly expressed his professional opinion that the American public needs to tell Washington it’s time to steer the nation off the path to financial ruin. The “accountant-in-chief” spoke on a Fiscal Wake-Up Tour panel during a meeting at the LBJ School of Public Affairs in Austin, Texas, on September 28, 2006:

What they don’t talk about is a dirty little secret everyone in Washington knows, or at least should. The vast majority of economists and budget analysts agree: The ship of state is on a disastrous course, and will founder on the reefs of economic disaster if nothing is done to correct it.

-David Walker

His basic message is this: If the U.S. government conducts business as usual over the next few decades, a national debt that is already $8.5 trillion could reach $46 trillion or more, adjusted for inflation. A hole that big could paralyze the U.S. economy; according to some projections, just the interest payments on a debt that big would be as much as all the taxes the government collects today. And every year that nothing is done about it, the problem grows by $2 trillion to $3 trillion (yes, that’s with a “t”). It doesn’t take a genius to recognize that an economic upheaval is in the making.

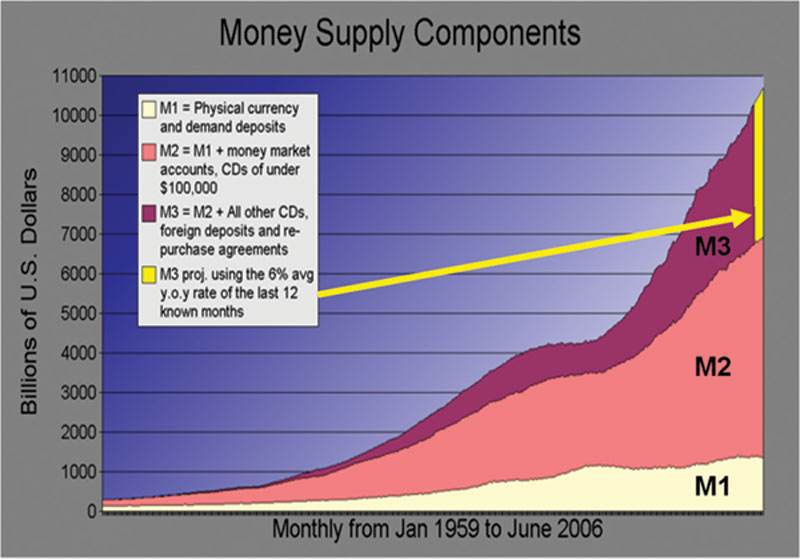

There are four traditional measures of the nation’s money supply: the M0, M1, M2, and-the most comprehensive-the M3. The M3 is the primary “report card” of the nation’s money management. However, the Fed is no longer publishing the M3, which economists have traditionally used to monitor the liquidity of the U.S. [Congressman Ron Paul introduced H.R. 4892 in an effort to reinstate publication of M3.]

U.S. Financial Report

On December 15, 2006, the Treasury issued the Financial Report of the United States as released by the U.S. Department of Treasury. The 2006 federal budget deficit was $4.6 trillion, not a previously reported $248.2 billion. The difference is that the typical report of the federal budget deficit is on a cash basis, in which all tax receipts are applied to current liabilities when received.

The Financial Report of the United States is calculated on a GAAP (“Generally Accepted Accounting Principles”) basis, which includes accruals made for current year changes in the net present value of unfunded liabilities in social insurance programs, such as Social Security and Medicare. This official report showed that the GAAP accounted negative net worth of the federal government has increased to $53.1 trillion, while the total federal obligations under GAAP accounting now total $54.6 trillion, taking into account the present value of future Social Security and Medicare liabilities. Put simply, this report shows that “arguments that the U.S. government is bankrupt have increasing merit...” (their words).

Hyperinflation Ahead?

The threat of hyperinflation isn’t just theoretical. Germany, in 1920, saw food prices double every 49 hours (a loaf of bread in 1920 cost 1 mark; in 1923 a loaf of bread cost 726,000,000 marks). (My grandparents sold a restaurant which, when the escrow was opened was worth enough to retire on; yet, by the time escrow closed, the proceeds could only purchase a loaf of bread.) In the 1990s, Russia’s currency devalued from 100/rubles/dollar in 1994 to 30,000 rubles/dollar in 1999.

The United States is now the largest debtor in the world ($48,000,000,000,000 in debt instruments). These obligations will ultimately have to be met with much cheaper dollars.

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

This cursory review hasn’t dealt with the leveraging effects of the substantial “financial derivatives” currently being employed, which would accelerate a potential crash even further! Your personal stewardship plans need to maintain surveillance on the likelihood of serious inflation ahead, and perhaps worse.

The Plot Thickens

There are serious people attempting to engineer the creation of a “North American Union,” and the establishment of a consolidated North American currency called the “Amero.” Some of the milestones which have been published would have no feasibility except under conditions of extreme urgency; however, those specific extreme circumstances may be deliberately being positioned for just such a purpose! Is our current debt debacle simply mismanagement? Or is it being engineered with a stratagem in mind? “Stay tuned. Film at eleven.”

Next Month: “The Vortex Strategy: Part 2.” This series will include steps you can take now to help prepare for the uncertainties ahead.