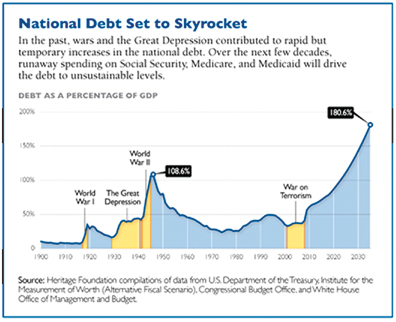

America’s economy is a mess. United States President Barack Obama’s budget would:

- Permanently expand the size of federal government spending by 3 percent of gross domestic product over 2007 levels;

- Double the national debt to over US$18 trillion;

- Borrow 42 cents for each dollar spent in 2010; and

- Place an additional debt of US$74,000 per household. This money will never be repaid in the current generation. The debt will be passed on the succeeding generations to pay.1,2

Even though the U.S. federal government’s tax revenue has more than tripled since 1965, the budget deficit will top $1.6 trillion in 2010. This spending hike would push spending to $36,000 per household by 2020. Obviously, something has to be done to reverse this trend. President Obama has shown that he is more interested in raising taxes than cutting spending. In his own words, “I do think at a certain point you’ve made enough money.”3 The implication is that an individual is only entitled to so much money; governments (and thus other people) are entitled to the rest.

To finance this continued increase in spending, the federal government is going to have to bring in new sources of revenue. Unfortunately the “revenue well” is almost dry. The total per capita tax burden born by Americans is rising to the highest level in history. The total taxes paid by an average American household will exceed US$16,000 in 2010. Corporate tax rates are at 35%, compared to 24% for the other OECD countries.4

These taxes will go even higher when the tax cuts enacted during the administration of President George W. Bush expire, as well as an increase in the dividends tax rate, an increase in the capital gains tax rate, and a total of 18 new taxes.5 Given the current political climate in the United States, it would be almost impossible to raise personal income taxes in the United States. An angry taxpayer can easily become an angry voter.

One idea for revenue that was first proposed in the 1950s and has come back for consideration is the Value Added Tax (VAT). When it was first introduced in Europe, it was directed at large businesses; it was extended over time to include all business sectors. In France, it is the most important source of state finance, accounting for nearly 50% of state revenues.6

The VAT is similar to a sales tax except that it is a tax that is levied at each stage of production. A sales tax is levied only when it is sold to the ultimate consumer. The advantage of a VAT is that it is a “hidden tax” that is not readily apparent to the consumer. The less visible a tax, the more tax revenue can be collected without complaints from the voters.

For example, the average total tax on gasoline in the United States is $0.47 per gallon (€0.094 per liter).7 Most consumers are unaware of this because it is included in the price of the gasoline. This tax, like all hidden taxes, shifts the blame of the tax costs from the government to the retailer. In the case above, the government is not blamed for siphoning off revenue without taking any of the risks associated with running an oil company; the higher costs are the fault of “greedy oil companies.”

In a strange turn of events, on April 19 the White House Press Secretary Robert Gibbs said, “This is not something the President has proposed, nor is it under consideration.”8 Two days later, President Barack Obama suggested that a new Value Added Tax on Americans is still on the table.9 In Washington, this type of behavior on the part of an administration means that plans are being made to seriously propose a program.

House Speaker Nancy Pelosi (D-Calif.) said on PBS’s “The Charlie Rose Show” that “it’s fair to look at” the VAT as part of an overhaul of the nation’s tax code. “I would say, ‘Put everything on the table and subject it to the scrutiny that it deserves.’” Pelosi told Rose when asked if the VAT has any appeal to her.10 The Presidents’ advisors are suggesting up to a 5% VAT as a start.

An Example – A Pen Manufacturer11

With no tax - The manufacturer spends $1.00 on materials and uses it to make a pen. The pen is then sold to a retailer for $1.20, making a gross revenue of $0.20. The retailer then sells the pen to a consumer for $1.50, making a gross revenue of $0.30.

With a 10% Provincial or Sales Tax - The manufacturer pays $1.00 for the raw materials, certifying it is not a final consumer. The manufacturer charges the retailer $1.20, checking that the retailer is not a consumer, leaving the same gross margin of $0.20. The retailer charges the consumer $1.65 ($1.50 + 10%) and pays the government $0.15, leaving the gross margin of $0.30. So the consumer has paid 10% ($0.15) extra, compared to the no taxation scheme, and the government has collected this amount in taxation.

The retailer paid no tax in this scheme, but is responsible for all the administrative work in keeping up with the tax collection.

With a 10% Value Added Tax - The manufacturer pays $1.10 ($1 + 10%) for the raw materials, and the seller of the raw materials pays the government $0.10. The manufacturer charges the retailer $1.32 ($1.20 + 10%) and pays the government $0.02 ($0.12 minus $0.10), leaving the same gross margin of $0.20. The retailer charges the consumer $1.65 ($1.50 + 10%) and pays the government $0.03 ($0.15 minus $0.12), leaving the gross margin of $0.30 ($1.65 - $1.32 - $0.03). In each case, the VAT paid is equal to 10% of the gross margin, or “value added.”

Confusing enough, but under the current plan being considered by the United States Congress, this tax would be in addition to any state and local taxes. The true, final cost to the consumer would be $1.80 ($1.50 + 10% VAT + 10% sales tax).

(Not all nations, provinces and states have these tax rates. These were used to make the mathematics easier.)

“Beware of the Camel’s Nose”

There is a story about a nomad traveling through the desert. The nomad pitches a small tent for the evening. When night-time comes, the camel asks to put just his nose under the tent to keep warm. As the night goes on, the camel pushes further into the tent until the camel is in the tent and nomad is outside. This is a fear many people have with the VAT. Proponents of the VAT say that it will “only” be a 1% tax; after all, it isn’t that much. The truth is that most countries that have implemented a VAT started out at a low tax rate, but increased over time.

The Wall Street Journal reports12 that the reality of a VAT is that rates often increase after implementation. Denmark’s VAT started at 9 percent, but soon increased to 25%, Germany’s increased from 10 to 19 percent, and Italy’s increased from 12 to 20 percent. On the other side of the world in New Zealand, they have a GST (Goods and Services Tax, but usually known as Grab, Snatch and Take) since 1986. The original rate was 10% but was raised to 12.5% in 1989. The current government of Prime Minister John Key is considering a rise in GST to no more than 15%, which is supposed to be accompanied by a decrease in personal taxes.

These countries have not reduced their borrowing as a result of the increased revenue, the borrowing increased. (Of the 10 major OECD nations with VATs or national sales taxes, only Canada has lowered its rate.) Most notably, Greece has raised its VAT twice this year from 19% to 21% on March 15th and then to 23% in May 2010. Before these increases went into effect, its debt as a share of GDP equaled 113%.13 The nonpartisan Tax Foundation recently calculated that to balance the U.S. federal budget with a VAT would require a rate of at least 18%.14 Implementing a VAT that high would throw the United States economy into a severe depression as is now being experienced in Greece and would be politically untenable. Any budget reform will have to include a cutback in spending.

It is a Regressive Tax

Taxes are classified in two ways, a Progressive Tax and a Regressive Tax. A progressive tax is one that taxes high income earners at a higher tax rate than low income earners. A regressive tax, like rain, falls equally on everyone, rich and poor. A VAT puts a larger burden on low income earners because, even though the dollar amount of the tax is the same for everyone, it takes a higher percentage of a poor person’s income.

Proponents of a Value Added Tax (and there are many) like the tax because it is a consumption tax. The tax only comes into play when a person consumes and thus gives the person an incentive to save. To counter the argument of the tax impacting the poor disproportionately, many countries exempt food, medicine, and essential services from a VAT, as well as tax credits on their personal income.

Because a VAT potentially taxes everything, it probably would be riddled with exemptions. Once the exemptions start (on food, medicine, etc.) it is hard to stop them. Would new home sales be exempt? What about sales on cars? Both of these industries are in trouble and could not stand another hit to their economic sector. A VAT can also be used to push a social agenda. A VAT could be imposed on “junk foods” while keeping “healthy foods” exempt. “Put down that soda and step away from the vending machine!”

No matter how it would be implemented, the Value Added Tax is a form of servitude. Although some taxation is necessary, all taxation diminishes freedom. Money is a tangible form of time. We trade our time and labor for money. Government, in the form of taxation, takes away some of our freedom because we are forced to give an increasing portion of our time to the government and getting less and less in return.

The Scriptures command us to submit to governing authorities.15 Jesus Himself said, “Give back to Caesar the things that are Caesar’s”. This means Christians must be good citizens, pay taxes, obey laws, and serve (as called) in government. Augustine argued that Christians are to be the best citizens: what others do only because the law demands, we do out of love for God. In these times, more than ever, we need to heed the words of the Holy Spirit as written by Paul to Timothy to pray for our leaders in government, that they govern wisely and with Christian charity.16

The students in the Koinonia Institute’s April Strategic Trends class contributed to the writing of this article.

Notes:

- Unless otherwise noted, all government spending figures are based on the White House Office of Management and Budget, Budget of the United States Government, Fiscal Year 2011 (Washington, D.C.: U.S. Government Printing Office, 2010).

- Also includes the cost of House-passed cap-and-trade bill, which President Obama endorsed yet excluded from his budget tables.

- Speech given in Quincy, Illinois on April 28, 2010 - http://www.youtube.com/watch?v=a6rTH5iO31M.

- The Organization for Economic Co-operation and Development is a Paris-based international economic organization of 30 and are regarded as the developed countries.

- http://www.heritage.org/Research/Reports/2010/04/Obamacare-Impact-on-Taxpayers.

- Le budget et les comptes de l’État. Minister of the Economy, Industry and Employment (France). 30 October 2009.

- American Petroleum Institute, 2010. April 2010 Notes to State Motor Fuel Excise Tax Report.

- http://www.cnsnews.com/news/print/64365.

- http://en.wikipedia.org/wiki/Value_added_tax.

- O’Brien, M. (2009, April 6). Pelosi says new tax is “on the table.” Retrieved April 30, 2010, from The Hill: Pelosi says new tax is “on the table.”

- http://en.wikipedia.org/wiki/Value_added_tax.

- Wall Street Journal, (April 15, 2010). Europe’s VAT Lessons, http://online.wsj.com/article/SB10001424052702304198004575172190620528592.html.

- ibid.

- ibid.

- Romans 13.

- 1 Timothy 2:1-15.